Want to get more information on Nations and Regions Investment Funds?

Register for our newsletter and get the latest updates on our Nations and Regions Investment funds.

Register for our newsletterOpen for applications

Equity Finance Up to £5 million

Equity finance is widely accepted as an important ingredient for businesses with potential for high growth.

Equity finance can be particularly important for new and innovative companies with high growth potential as it can provide long-term backing to fund business growth through to revenue and profit. In simple terms, equity finance is raising capital through the sale of shares in a business.

The Investment Fund for Scotland has particular interest in supporting equity investments, helping the Nation to become a vibrant and sustainable venture capital market. An equity-based investment could be right if you run an established business with ambitious plans, or a large start up with high growth potential.

How it works

- Go to the fund manager’s website by clicking the box below.

- Make an enquiry directly to the fund manager.

- The fund manager will contact you to talk through your funding requirement.

- The fund manager may ask for more information and a formal application or pitch deck.

- The fund manager will evaluate your application and make the investment decision.

Have a question? Read our Frequently Asked Questions.

Funds Available

Latest news from the Investment Fund for Scotland

Press release

Blog post

Press release

Investment Fund for Scotland in the news

The Scottish tech ecosystem is showing significant momentum

Two thirds of the Investment Fund for Scotland’s impact to date has been focused on the burgeoning sector. Mark Sterritt, Director, Nations & Regions Investment Funds share his thoughts with Insider.

Learn more About the Scottish tech ecosystem is showing significant momentumEdinburgh sportswear company secures £750k loan for growth

SportsPro, an Edinburgh-based provider of pro and amateur sportswear, has secured a £750,000 growth loan from the British Business Bank’s Investment Fund for Scotland, via appointed Fund Manager, The FSE Group.

Learn more About Edinburgh sportswear company secures £750k loan for growthEntrepreneur brings next generation drone tech to Scotland with £48k from IFS

A Melrose-based entrepreneur is set to revolutionise Scottish agriculture by becoming the first in the country to offer advanced crop spraying services using a state-of-the-art, supersized drone.

Learn more about Entrepreneur brings next generation drone tech to Scotland with £48k from IFSInvestment Fund for Scotland Success Stories

Podfather

Cloud-based logistics software business Podfather received a £3.4 million investment to support their ambitious growth strategy.

Sky-Pin Drones

Melrose-based entrepreneur offers advanced crop spraying services using state-of the-art supersized drone following funding from the Investment Fund for Scotland.

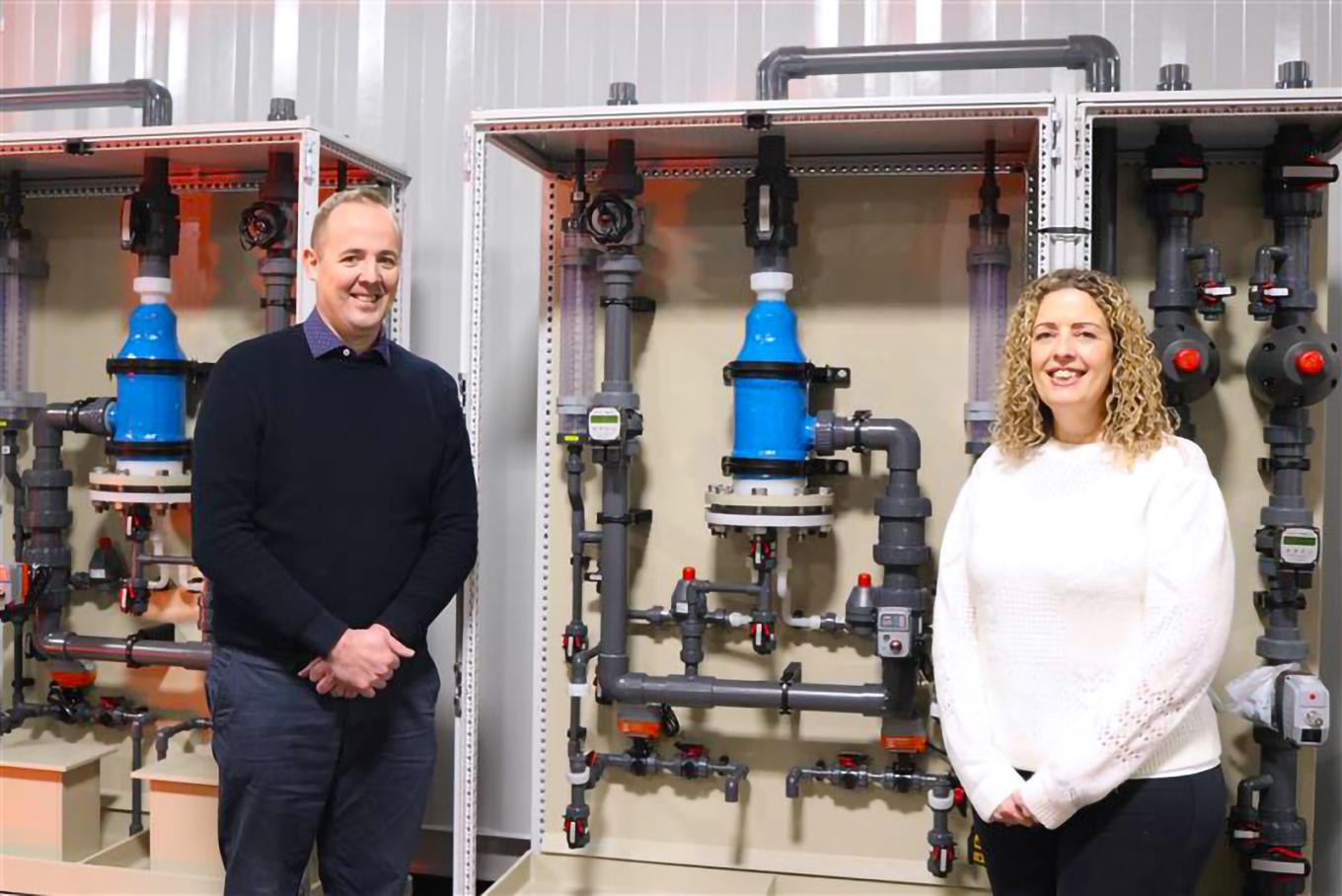

Scotmas

B-Corp accredited specialist water treatment technologies business, Scotmas secured £2.2 million in equity funding to support its international expansion plans.

Sign up for our newsletter

Just add your details to receive updates and news from the British Business Bank

Sign up to our newsletter