Want to get more information on Nations and Regions Investment Funds?

Register for our newsletter and get the latest updates on our Nations and Regions Investment funds.

Register for our newsletterOpen for applications

Questions about the Investment Fund for Scotland

How do I apply for IFS funding?

Enquiries and applications are made direct to IFS’s selected fund managers, full details of which can be viewed here . IFS cannot provide financial or business advice to businesses seeking funding and businesses may wish to engage their own accountant or business adviser if application assistance is required.

How does IFS invest?

IFS does not invest directly in businesses. It invests through product funds which are managed by IFS’s appointed fund managers. The Fund will offer three commercial finance options with Smaller Loans from £25k to £100k, Debt Finance from £100k to £2m and Equity Finance up to £5 million.

My bank can’t fund the total amount that I need, how can IFS help?

IFS’s product funds can invest alone or alongside other sources of debt or equity capital where appropriate.

What funding is not eligible for IFS support?

IFS will have an inclusive approach, but some eligibility criteria do apply to IFS funding and fund managers will be able to advise on suitability.

What is the Investment Fund for Scotland?

The Investment Fund for Scotland (IFS) will deliver a £150m commitment of new funding through investment strategies that best meet the needs of the businesses in Scotland. IFS is designed to drive sustainable economic growth by supporting innovation and creating local opportunity for new and growing businesses across Scotland. IFS will increase the supply and diversity of early-stage finance for smaller businesses in Scotland, providing funds to firms that might otherwise not receive investment and help to break down barriers in access to finance.

What type of funding does IFS offer?

IFS will offer three commercial finance options with Smaller Loans from £25k to £100k, Debt Finance from £100k to £2m and Equity Finance up to £5 million.

What's the difference between IFS and high street finance providers?

IFS has been designed to help address market gaps by increasing the supply and diversity of early-stage finance for UK smaller businesses, providing funds to firms that might otherwise not receive investment. The product funds that IFS supports provide commercially focussed funding to businesses across Scotland. IFS’s product funds can invest alone or alongside other funders, and indeed IFS fund managers are encouraged to leverage-in additional private capital.

Where do I need to be based to apply for a IFS investment?

IFS covers the whole of Scotland, including rural, coastal and urban areas. Investments can be made in businesses that are headquartered in Scotland or have a significant operating presence there.

Latest news from the Investment Fund for Scotland

Press release

Blog post

Press release

Investment Fund for Scotland in the news

The Scottish tech ecosystem is showing significant momentum

Two thirds of the Investment Fund for Scotland’s impact to date has been focused on the burgeoning sector. Mark Sterritt, Director, Nations & Regions Investment Funds share his thoughts with Insider.

Learn more About the Scottish tech ecosystem is showing significant momentumEdinburgh sportswear company secures £750k loan for growth

SportsPro, an Edinburgh-based provider of pro and amateur sportswear, has secured a £750,000 growth loan from the British Business Bank’s Investment Fund for Scotland, via appointed Fund Manager, The FSE Group.

Learn more About Edinburgh sportswear company secures £750k loan for growthEntrepreneur brings next generation drone tech to Scotland with £48k from IFS

A Melrose-based entrepreneur is set to revolutionise Scottish agriculture by becoming the first in the country to offer advanced crop spraying services using a state-of-the-art, supersized drone.

Learn more about Entrepreneur brings next generation drone tech to Scotland with £48k from IFSInvestment Fund for Scotland Success Stories

Podfather

Cloud-based logistics software business Podfather received a £3.4 million investment to support their ambitious growth strategy.

Sky-Pin Drones

Melrose-based entrepreneur offers advanced crop spraying services using state-of the-art supersized drone following funding from the Investment Fund for Scotland.

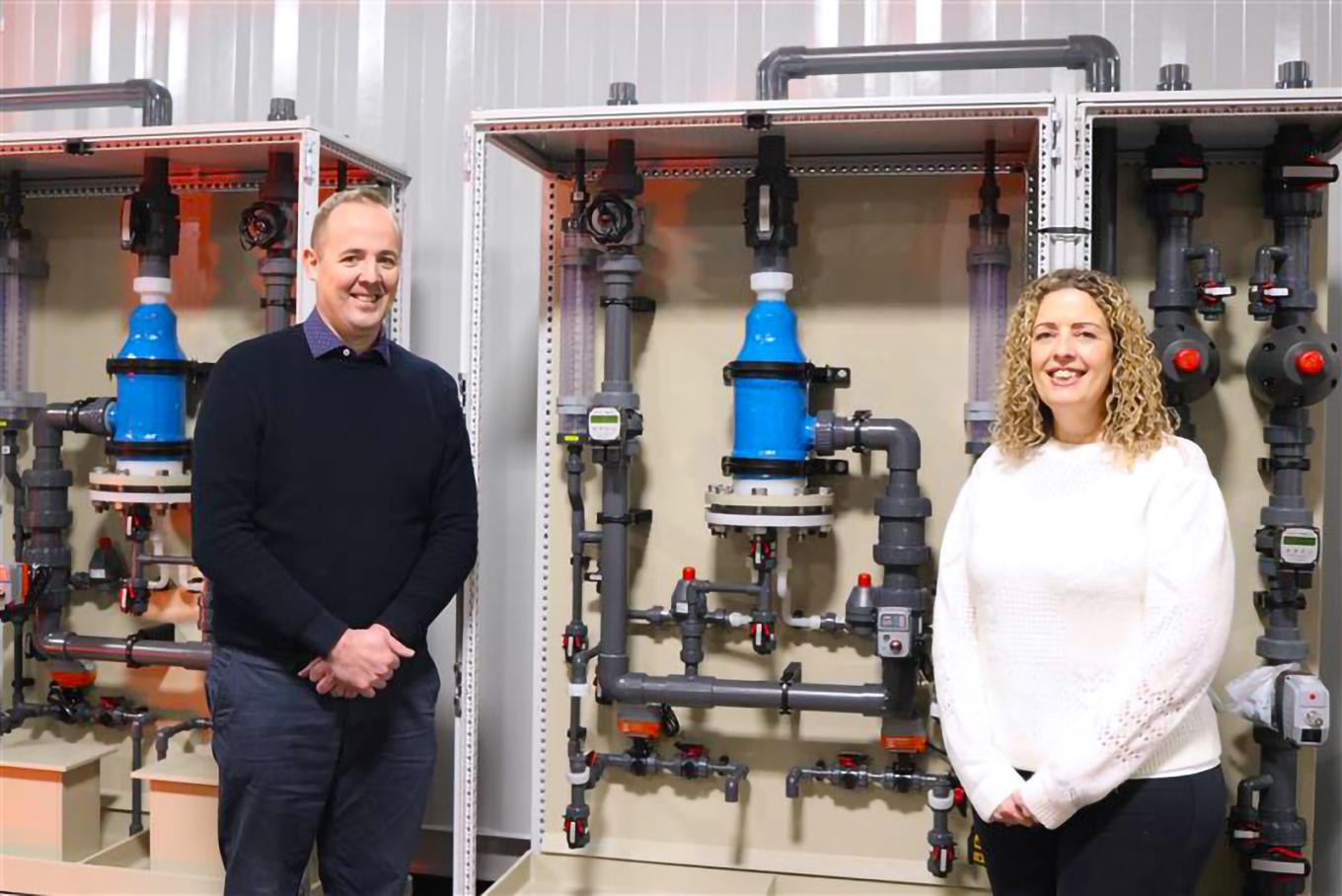

Scotmas

B-Corp accredited specialist water treatment technologies business, Scotmas secured £2.2 million in equity funding to support its international expansion plans.

Sign up for our newsletter

Just add your details to receive updates and news from the British Business Bank

Sign up to our newsletter